Computer Accessories HSN Code: Complete Guide for Importers and Exporters

Greetings, Readers! In this article, we will provide you with a comprehensive guide on computer accessories HSN code, which is essential for importers and exporters. Understanding the HSN code for computer accessories is crucial for proper classification and compliance with customs regulations. So, let’s dive into the world of HSN codes and discover everything you need to know!

Introduction

The Harmonized System of Nomenclature (HSN) is an internationally recognized system used for classifying goods for customs purposes. Each product is assigned a unique HSN code that enables seamless trade across borders. Computer accessories, such as keyboards, mice, monitors, and cables, are no exception. By correctly identifying the HSN code for computer accessories, importers and exporters can ensure smooth customs clearance and avoid penalties.

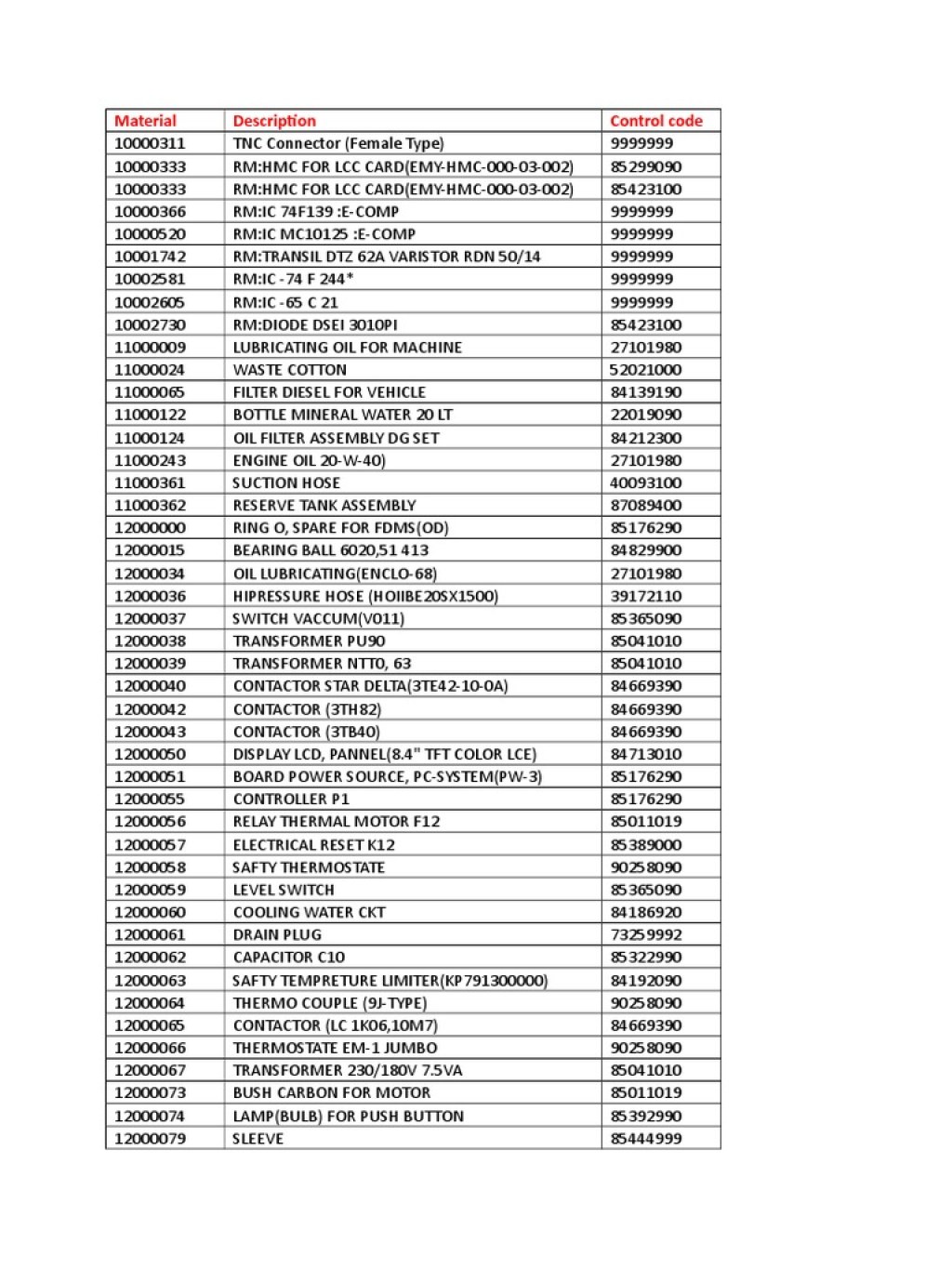

To help you navigate through the complexities of HSN codes for computer accessories, we have compiled a table containing all the necessary information:

Product

HSN Code

Description

Keyboards

8471

Input device for computers

Image Source: scribdassets.com

Mice

8471

Pointing device for computers

Monitors

8528

Output device for computers

Cables

8544

Connectivity accessory for computers

What is the HSN code for computer accessories?

The HSN code for computer accessories refers to the classification code assigned to these products under the Harmonized System. It helps in identifying the category to which a particular computer accessory belongs. For example, keyboards and mice fall under the same HSN code, while monitors and cables have different codes.

What is the HSN code for keyboards?

The HSN code for keyboards is 8471. Keyboards are essential input devices used to enter data and commands into a computer system. Whether it’s a standard keyboard or a gaming keyboard, the HSN code remains the same.

What is the HSN code for mice?

Like keyboards, mice also fall under the HSN code 8471. Mice are pointing devices that allow users to control the cursor on the computer screen. Whether it’s a wired or wireless mouse, the HSN code remains constant.

What is the HSN code for monitors?

The HSN code for monitors is 8528. Monitors are output devices that display visual information produced by the computer. This includes computer monitors, LED screens, and LCD screens, all of which have the same HSN code.

What is the HSN code for cables?

Cables used for connecting computer accessories, such as USB cables, HDMI cables, and VGA cables, fall under the HSN code 8544. These cables are crucial for establishing connectivity between various computer peripherals and the main system.

Advantages and Disadvantages of Computer Accessories HSN Code

Understanding the HSN code for computer accessories offers several advantages:

1. 🚀 Simplifies Trade: HSN codes streamline international trade by providing a standardized classification system for computer accessories.

2. 📃 Easy Documentation: Importers and exporters can easily prepare necessary documents, such as invoices and shipping bills, by including the correct HSN code.

3. 💰 Tariff Calculation: HSN codes play a crucial role in determining the applicable customs duty rates for computer accessories, helping businesses calculate costs accurately.

4. ⚖️ Compliance with Regulations: By using the correct HSN code, importers and exporters ensure compliance with customs regulations, avoiding penalties and delays.

5. 📊 Statistical Monitoring: Governments and trade organizations use HSN codes to monitor trade statistics, enabling them to analyze trends and make informed policy decisions.

Despite the advantages, there are a few disadvantages to consider as well:

1. ⏳ Complexity: The HSN code system can be complex, requiring a thorough understanding of the classification rules and guidelines.

2. 🔄 Regular Updates: HSN codes are periodically updated to accommodate changes in technology and product classifications, necessitating continuous awareness and adaptation.

3. 🌍 International Variations: While the HSN code system is globally recognized, some countries may have specific variations or additional codes, adding complexity to cross-border trade.

Frequently Asked Questions (FAQs)

1. What are the penalties for using the wrong HSN code for computer accessories?

Using the wrong HSN code may result in penalties, such as fines and delays in customs clearance. It is crucial to accurately classify computer accessories to ensure compliance and avoid such consequences.

2. Can the same HSN code be used for computer accessories in different countries?

While HSN codes are internationally recognized, some countries may have variations or additional codes specific to their customs regulations. It is necessary to consult the customs authorities of each country to ensure compliance.

3. How often are HSN codes updated for computer accessories?

HSN codes are updated periodically to reflect technological advancements and changes in product classifications. Importers and exporters should stay updated on these changes to avoid any non-compliance issues.

4. Are there any exemptions or special provisions for computer accessories under HSN codes?

Exemptions or special provisions for computer accessories may vary from country to country. It is advisable to consult the customs authorities or seek professional advice to understand any specific provisions applicable to your trade.

5. Can computer accessories be classified under multiple HSN codes?

In some cases, certain computer accessories may be classified under multiple HSN codes. This depends on the specific functionality and characteristics of the product. It is important to accurately determine the most appropriate HSN code based on the product’s primary function.

Conclusion

In conclusion, understanding the HSN code for computer accessories is vital for importers and exporters to ensure smooth customs clearance and compliance with regulations. By correctly classifying computer accessories and including the appropriate HSN code in documentation, businesses can avoid penalties and delays. It is essential to stay updated on any changes in HSN codes and consult the customs authorities for specific country requirements. So, embrace the power of HSN codes and simplify your international trade of computer accessories!

Take action now and classify your computer accessories with the correct HSN code!

Disclaimer: The information provided in this article is for general informational purposes only and should not be considered legal or professional advice. We recommend consulting with customs authorities or trade professionals for specific guidance regarding HSN codes and customs regulations.